District Industries and Commerce Centre

About:

The District Industries Centres (DIC’s) programme was started in 1978 with a view to providing integrated administrative framework at the district level for promotion of small scale industries. District Industries & Commerce Centrefunctions under the Commissioner of Industries & Commerce, Assam and act as a single agency in the district to provide all the services and support facilities to the entrepreneurs for setting up Micro, Small, Medium and large Enterprises.

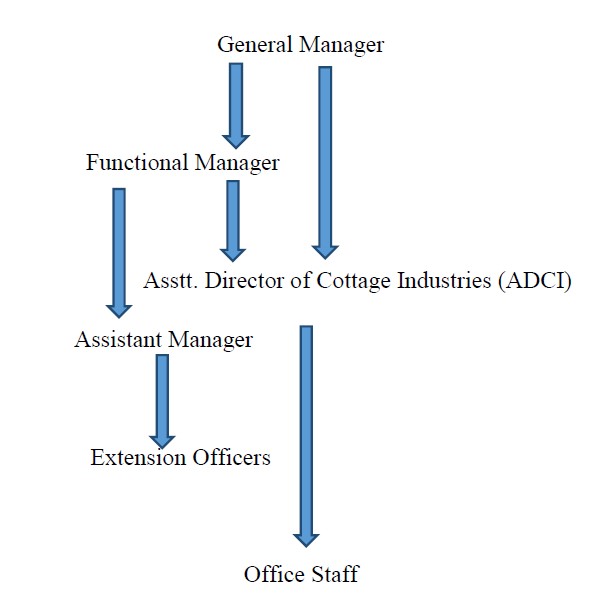

Organization Chart:

Objectives of District Industries Centre (DI&CC):

- Accelerate the overall efforts for industrialization of the district for sustainable economic growth.

- Facilitating the development of rural traditional industries and handicrafts.

- Attainment of economic equality in various regions of the district and employment generation through MSMEs.

- Providing the benefit of various government schemes to the new entrepreneurs.

Projects & Schemes:

- Prime Minister’s Employment Generation Programme (PMEGP)

- The scheme is implemented by Khadi and Village Industries Commission (KVIC) functioning as the nodal agency at the national level. At the state level, the scheme is implemented through State KVIC Directorates, State KVIBs, District Industries Centres (DICs) and banks.

- The maximum cost of the project/unit admissible in manufacturing sector is ₹ 50 lakhs and in the business/service sector, it is ₹ 20 lakhs.

- 35% and 25% Govt. subsidies on project cost have been provided for rural and urban areas of North Eastern states respectively.

- Provision of taking 2nd loan for up gradation of existing PMEGP Units with 20% Govt. subsidy.

- For availing 2nd Loan, the maximum cost of the project/unit admissible in manufacturing sector is ₹ 1 Croreand in the business/service sector, it is ₹ 25 lakhs.

Eligibility criteria:

- Any individual, above 18 years of age

- No income ceiling

- No bar on educational qualification for projects costing below Rs.10 lakh in the manufacturing sector and below Rs. 5 lakh in the business /service sector

- Assistance under the scheme will be available for new units only.

- Pradhan MantriFormalisation of Micro Food Processing Enterprise Scheme(PMFME)

Support to Individual Micro Enterprises:

- Food processing entrepreneurs through credit-linked capital subsidy @35% of the eligible project cost with a maximum ceiling of Rs.10 lakh per unit.

- Both existing and new micro food processing enterprise can apply.

- Proposal for both ODOP and non-ODOP are eligible for assistance.

- Organisations such as individual entrepreneurs/ proprietorship firms/partnership firm/ FPOs / NGOs/ Cooperatives/ SHGs/ Pvt. Ltd. Companies would be eligible

- The individual applicant should be above 18 years of age. No minimum educational qualification is required.

- Applicant is eligible for bank credit even if he/she has availed credit in other Govt. subsidy scheme.

- Providing Capacity building and training support to increase the capabilities of the enterprises and up gradation of skills of workers.

Support to Group category for setting up of common infrastructure:

- Existing or New organisations such as FPOs, FPCs, Cooperatives, SHGs and its federation/Govt. agencies related to food processing sector would be eligible.

- Support for common infrastructure and handholding support to SHGs, FPOs and Producer Cooperatives.

- Applicant organization would be provided credit-linked capital subsidy @35% of the eligible project cost with a maximum ceiling of Rs.3 Crore. Eligible project cost comprises cost of plant & machinery and technical civil works, but excludes cost of land/rental or lease work shed.

- Providing Capacity building and training support to increase the capabilities of the enterprises and up gradation of skills of workers.

- MukhyaMantrirTholuwa Udyog BikashAchani

Introduced in FY 2018-19 to provide assistance to the Handicraft industries & clusters present in all districts of Assam to promote the livelihood of artisans and to boost their activities with new technology and design. Tools and equipment for improvement of finished products have already been provided under the scheme.

- Assam Tea Industries Special Incentives Scheme(ATISIS),2020 :

- This scheme is applicable for the period of 3 years from 1st April’2020 to 31st March 2023. It has four components:

- Interest subvention on working capital @3% per annum.

- Orthodox or Specialty Tea Production subsidy @Rs.7.00 per Kg

- Subsidy of 25% on Plant & Machinery for Orthodox or Speciality Tea Unit (UptoRs. 30.00 Lakh)

- Agricultural tax holiday

- Applications can be submitted online through the website https://atisis.assam.gov.in/atsisver/login.html

Assam Agribusiness and Rural Transformation Project (APART) :

The “Assam Agribusiness and Rural Transformation Project (APART)” is being implemented by the Government of Assam with the Project Development Objective (PDO) to “increase value-added and improve resilience of selected agriculture value chains, focusing on smallholder farmers and agro-entrepreneurs in targeted districts of Assam”. One approach of achieving the PDO is through facilitating the growth of agri enterprise clusters to increase competitiveness, revenue and employment growth; and supporting development of modern supply chains which is one of the components of the project.

The Project Coordination Unit (PCU) is the headquarter of the Society, which is headed by a State Project Director and Govt. of Assam assigned ARIAS Society as the Project Coordination Unit for implementation of the project in association with the department of Industries, Government of Assam as the Operational Project Implementation Unit (OPIU) for the sub component B1 of the project.

Grant Thornton India LLP has been hired as the Cluster Development Technical Agency (CDTA) for implementation of sub-component B1 of the project for supporting establishment of cluster level Industry Associations. The overall objective of the CDTA is to promote agro MSMEs in the State through cluster development approach by formation of industrial associations with targeted vision, development of AIDPs, formation of common facility centre, access to business development services for marketing, finance, other linkages, Skill development, technology by way of common facilities etc. and understanding business policies, procedures & practices.

Incentives and Subsidies:

Industrial & Investment Policy Assam, 2019 (IIPA, 2019).

- State Goods and Services Tax reimbursement for 15 years ranging from 150% to 250% of fixed capital investment.

- Power Subsidy @Rs.2 per unit for a period 5 years subject to a maximum of Rs.50 lakh per annum.

- 50% Generating set subsidy subject to a ceiling of Rs. 20 lakh.

- 100 % stamp duty exemption subject to a ceiling of Rs. 25 lakh for purchase of land.

- 75% subsidy on Technology transfer subject to a ceiling of Rs.10 lakh.

- 2% Interest subsidy on working Capital for 5 years subject to a ceiling of Rs. 50 lakh per unit

- Financial Assistance to MSME @ 30% subsidy, subject to a ceiling of Rs.5 lakh for listed in Stock exchange.

- Financial assistance for environmental compliances @50% subject to a ceiling of Rs.25 lakh.

- Incentive for private sector Infrastructure developer @30% subject to a ceiling of Rs. 3 Cr. The land area should be not below 30 acres.

- Incentives for local employment generation @ Rs.10000 for each employment.

- Special dispensation to the unit where the investment is above Rs.1000 Cr or employment 2000 people.

North East Industrial Development Scheme, 2017. (NEIDS, 2017)

It was introduced on 1st April’2017 and registration under the Scheme was valid up to 31st March’2022. Registered units can avail the following incentives:

- Central Capital Investment subsidy @30% subject to a ceiling of Rs. 5 Cr

- Central Interest Incentive on working capital @3% for a period of 5 years.

- Reimbursement of 100% Insurance premium for a period of 5 years.

- Reimbursement of CGST and IGST for a period of 5 years.

- Income Tax reimbursement of first 5 years.

- Transport Incentives

- Additional 3.67 % of the employer's contribution towards EPF in addition to 8.33 %contribution made by GOI.

Branches & Offices:

- Office of the General Manager

District Industries & Commerce Centre,

Borpukhuri Par, Sivasagar-785640

- Office of the AssistantDirector of Cottage Industries

Nazira, Sivasagar-

- Office of the Manager, Industrial Estate, Dorikapar

Sivasagar- 785640